UK MBOs down 49%

Management have become nervous of 'risky' moves as Brexit uncertainty continues, causing a drop in MBOs over the last 12 months.

Management have become nervous of 'risky' moves as Brexit uncertainty continues, causing a drop in MBOs over the last 12 months.

Jamie Johnson, Director at Moore Stephens, examines the drop in MBOs and why they are critical for UK business.

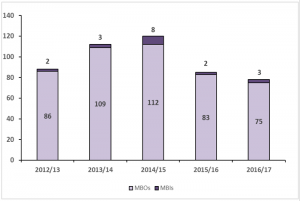

Private equity backed management buyouts (MBOs) have fallen by 49% in the last 12 months compared to two years ago, according to research by Moore Stephens.

A major driver behind this drop in MBOs is the political and economic uncertainty around Brexit, which has resulted in nervousness from management in making any ‘risky’ moves, such as taking on significant personal debt as part of an MBO.

Whilst the number of deals are down, there have been some interesting MBOs taking place in the last few years over a wide range of sectors, with valuation multiples still appearing strong but not too aggressive.

“Many MBO teams do not have strong finance directors on their team, and this can be an issue,” explains Jamie Johnson, a director in the Moore Stephens Corporate Finance team. “A strong finance director can alleviate some of the risks which many teams perceive in MBO transactions.”

The challenge that the market now faces is how to ensure that committed capital is invested in good quality businesses. Supporting MBOs should be a core part of this, and the finance director’s role within a transaction can be crucial. Key areas the finance director can help other members of the team include:

Ensuring the rest of the management team has a good understanding of the financial health of the business. Discussions around valuation can be difficult because of the relationship which the team has with the current owner/s. Understanding the financial health of the business can make these discussions easier as the team will be able to work with advisers to arrive at a fair market value for the management team offer.

Preparing integrated forecasts looking at a business’s growth potential in the current economic environment. There is a need for careful consideration of the working capital requirements and stresses that growth in business may cause. Understanding forecasts and the working capital cycle are crucial to structuring a transaction, ensuring the business is not over geared and that any growth can be financed without having to go back to the market for further money.

Reviewing debt collection and customer billing cycles. The flow of funds and the cycles of cash flows are very important in funding and structuring an MBO. Being able to explain in detail how a business operates also helps a funder to understand how a return on investment can be made. Chasing old debts and keeping customer billing cycles tight will all help working capital and should be part of getting a business’ house in order as part of any MBO.

MBOs are critical to the UK for maintaining the growth of innovative private business, and they create significant opportunities for job creation, while also helping to protect long standing UK businesses that want to stay private.

Johnson adds: “Finance directors are in a unique position to understand the impact of financial pressures on the business and can help MBO teams to evaluate these uncertainties and determine whether the financial gains will out-weigh the concerns.”

It is also worth noting that whilst certain reports have suggested UK banks are not as ready to support businesses, this may not be the case in reality. More often than not, business owners are concerned about leverage in their businesses, which can hold back many MBOs. A business’ existing banking relationship will often be keen to support the growth and development of a business, especially where they have a strong relationship with the finance director.

MBOs are also a great option for allowing an existing owner to retire from the business, crystallising their years of investment (time and money) whilst also giving the management team the opportunity to grow and develop their own business from a stable starting point.

“Many MBOs lead to secondary and tertiary buyouts in the future, as owners look to maintain the culture and longevity of the business whilst providing their teams with the opportunities they were given”, says Johnson. “They are not, however, for the faint hearted and management teams need to be prepared to step up to be owners and take on the 24/7 life that it entails.”

Given the wealth of capital looking to back good UK management teams in mid-market transactions, there are a significant number of companies that could benefit from preparing themselves for taking on potential investment and therefore being MBO-ready if the opportunity arises. Johnson adds: “Finance directors can be part of leading the charge on these opportunities, providing funders with comfort that a business’s financial health is in safe hands.”

Jamie Johnson is Director at at top ten accountancy firm, Moore Stephens.