Are you ready for MiFID II?

As the implementation date for MiFID II fast approaches, we take a look at who is affected and what options there are for businesses to remain compliant

As the implementation date for MiFID II fast approaches, we take a look at who is affected and what options there are for businesses to remain compliant

Dave Millett, Managing Director at leading brokerage firm, Equinox, discusses who is affected by the new regulation and how to remain compliant

One of the many responsibilities of finance directors is ensuring regulatory compliance. For those FDs who are involved in the Financial Services sector, this job is about to get more complex, as MiFID II comes into force.

Despite this, there is still a lack of awareness on the implications of the changes and who will be affected, according to recent research.

The new legislation comes into effect on January 3, 2018 and includes a revised MiFID and a new Markets in Financial Instruments Regulation (MiFIR). As a result, many companies, especially smaller organisations that fell outside of the original legislation, will now be required to adopt new procedures for recording communications.

The original MiFID regulations were applied in the UK from November 2007, but are now being revised to improve the functioning of financial markets in light of the financial crisis and to strengthen investor protection. They will also create a lot of work and potential cost for organisations that will now come under its coverage.

Several surveys have shown that many companies remain unaware of MiFID II’s implications or don’t think they will be compliant in time. A survey of senior financial services professionals by corporate finance adviser, Duff & Phelps, showed that just 36% of financial services firms subject to MiFID II, are confident they will be able to comply with the regulation by the January 2018 implementation date.

When will MiFID II come into force?

For those hoping Brexit might affect the application of the rules in the UK, they will be disappointed. The implementation date has already been extended by one year – from January 2017 – to allow firms to finalise their preparations, so further extension is not an option.

Who needs to comply?

Exactly which types of companies will be caught up by this new legislation is not 100% clear. The documentation lists services that will now be covered but companies are left to decide if it affects them or not.

It is generally accepted that commodities companies that were left outside of the first MIFID will now be covered, as will insurance brokers’ take cover products which have an ‘investment element’ i.e. where that maturity or surrender value is wholly or partially exposed, directly or indirectly, to market fluctuations. This would also suggest that many IFAs and mortgage brokers may need to comply.

There is also a view that corporate finance companies, investment firms, credit institutions, and broker/dealers will be covered by the new legislation.

How to be compliant

Organisations affected by MiFID II will be required to record all relevant electronic communications, as well as in-person meetings and telephone calls.

This needs to be done for communications relating to both actual or possible transactions, for clients and on the firm’s own account.

Record keeping will be vital: records will have to be kept for a minimum of five years, and in some cases seven years or for the duration of the client relationship.

Compliance options

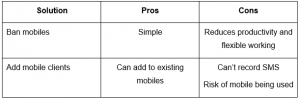

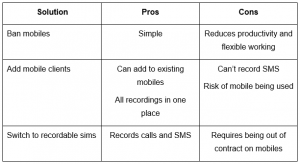

So what are the options for telecoms on both fixed and mobile telecoms? In terms of fixed lines, it depends on what you currently have in place.

Mobiles can be a bit more challenging and it will be impacted as to whether as a business you or your staff use sms to communicate with customers.

Clearly there are solutions available. However, you may find that you are part way through a contract and your current supplier cannot offer or support these solutions. Some interesting legal issues will need to be dealt with in such a situation, for example, FCA compliant call recording won’t be provided by many VoIP suppliers.

If so, can these suppliers charge a penalty for leaving to go to another supplier that can offer complaint services? This may not be the case when the product is no longer fit for purpose.

The same would be true if you are part way through a mobile contract. There is probably a stronger argument where your supplier gave you handsets or other hardware as part of the deal and was spreading the costs over the contract.

In this case that they could ask for the balance to be paid for, providing they unlocked the handsets so you can reuse them.

It could also be seen as an opportunity, so if you are going to start recording for the first time, this can also be used as a tool to improve customer service. More sophisticated solutions even enable the use of analytics or word spotting to flag or alert specific calls.

As the implementation date of MiFID II gets closer, FDs need to ensure that their organisations have confirmed whether or not they need to be recording their communications and are getting the detailed procedures, client communication and staff training in place.

Dave Millett has over 35 years’ experience in the Telecoms Industry, having worked in European Director roles for several global companies. He now runs Equinox, a leading independent brokerage and consultancy firm.