A guide to IFRS 16 leases - the journey to compliance

Under the new leasing rules in IFRS 16, operating leases will soon be on balance sheet - here's everything you need to know to comply with the new rules

Under the new leasing rules in IFRS 16, operating leases will soon be on balance sheet - here's everything you need to know to comply with the new rules

Jonathan Wallis, Director & Financial Reporting Advisory Group Lead, and Neil Parsons, Senior Manager, Financial Reporting, National Assurance Services at Grant Thornton UK LLP, explain what will change with IFRS 16 and steps to take to be ready for the new rules

It is no urban myth that Sir David Tweedie, the former Chairman of the International Accounting Standards Board (IASB), stated that he believed he had never flown on an aeroplane that appeared on the airline’s balance sheet. Funding a fleet of aircraft outright is very expensive, so airlines will generally lease them. This spark created the idea to radically change lease accounting.

A lease can be off balance sheet, meaning that no related asset or corresponding contractual liability to make payments is reported. This is the case for the leases of many ‘big ticket’ items such as real estate and major items of plant and equipment. It is possible to structure leases so they are off balance sheet, even though the liabilities are real.

Sir Tweedie considered this practise unacceptable and now, after many years of detailed work and public consultation following his retirement, the IASB have changed their accounting rules so most leases will now go on balance sheet.

The UK is the largest leasing market in Europe and, according to the Finance and Leasing Association, £30 billion of asset acquisitions in 2016 were through a lease in the UK. Across the world, trillions of dollars of leases exist, so the affect of the new lease accounting rules is massive.

Under current rules, a type of lease known as an operating lease is an off-balance sheet arrangement including aeroplanes, trains and the buildings we work, rest, and shop in. However, under the new leasing rules contained in IFRS 16, they will soon be on balance sheet, but the lessor will retain their old accounting model.

For lessees, how does the current leasing model work?

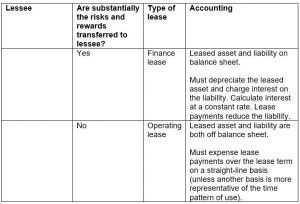

First, we must visit the existing lease accounting model, a risk based model where the appearance of a lease on the balance sheet of a lessee occurs only where it transfers the risks and rewards of ownership of an asset. The transfer of risks and rewards is a judgement made by the lessee based on a set of indicators.

Under the existing model, it is possible to structure a lease in order to achieve a specific reporting outcome, by adjusting the lease agreement to prevent the risks and rewards passing. This has led to some criticism of the existing model, and a need for change.

So what is IFRS 16?

IFRS 16 Leases is the new IFRS standard replacing the existing model on accounting for leases, which centred on IAS 17 (originally dating back to 1982).

How does IFRS 16 define a lease?

Firstly, IFRS 16 introduces an updated definition of a lease as follows:

“A lease is a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.”

This revised definition should make it easier to identify those transactions that are leases, no matter how it is structured. It is critical that an underlying asset must exist, the use of which is integral to fulfilling the arrangement.

Arrangements that contain leases, for example IT contracts, might contain services but rely on the use of specified assets. In fact, a practical expedient allows an arrangement containing a service and a lease to be treated as a lease, thus negating any calculations to separate the arrangements into their components.

How does a lessee account for a lease under IFRS 16?

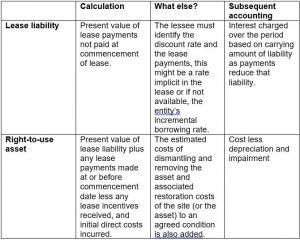

For lessees, the distinction between operating lease and finance lease disappears. Unless IFRS 16 allows exemption from not recognising a lease on balance sheet, all leases come onto the balance sheet as a right-to-use asset with a corresponding obligation to pay for that asset.

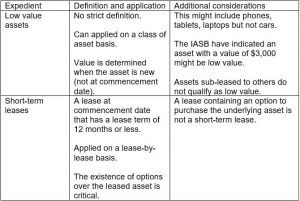

As a practical expedient, IFRS 16 permits expensing the following types of lease, normally on a straight-line basis unless another basis is appropriate and therefore they are not included on balance sheet.

Who is affected?

In the UK, those entities applying IFRS as endorsed for use in the EU, are affected. Entities applying FRS 101 Reduced Disclosure Framework will also need to apply IFRS 16 to their leases.

Entities currently applying FRS 102 but planning an IPO after 2018 would need to apply the new requirements in historical financial information prepared for the listing, under IFRS.

Key dates

IFRS 16 is first applicable for accounting periods commencing on, or after 1 January 2019. An entity with an accounting reference date of 31 March will first need to implement the new standard in its annual report and financial statements for the year ended 31 March 2020 (a period commencing on 1 April 2019).

The Financial Reporting Council (FRC) have also recently stated that they expect companies to make detailed, quantitative disclosures explaining the expected impact of new standards, such as IFRS 16, on their reporting in the last set of financial statements before the implementation date. This is very important for the 2017 reporting season.

It is not only annual accounts that are important. A listed entity will first need to implement the new requirements in their half-yearly report, i.e. well before the publication date of their first annual report implementing IFRS 16.

An entity with a 31 December year-end, with a primary (or secondary) listing of equity shares on the London Stock Exchange must publish their half-yearly report for the period ended 30 June 2019 no later than 30 September 2019.

We are expecting the EU to endorse IFRS 16 for use before the end of 2017, thus enabling early application, as long as IFRS 15 Revenue from contracts with customers is also applied. Early implementation dramatically accelerates the implementation process.

The practical aspects – a proactive response is needed

Most businesses we speak to are aware that there is a problem looming. However, in many cases that awareness has not yet led to a proactive response to tackle the problem.

Hesitation is a natural reaction. Finance teams are overwhelmed with the level of effort required to adopt IFRS 16, given the increasing pressure on them to do more work with fewer resources.

A successful transition requires updating existing accounting policies, procedures and systems. Even if accounting policies are not affected, significant new disclosures will be required. Post implementation, IFRS 16 will require continual management of all lease activities and portfolios.

The starting point for operating lease information is usually a spreadsheet. Working out the next steps on how to turn that data into ‘IFRS 16 compliant’ numbers (whilst continuing the day-to-day operations) is at first daunting for even the most experienced project team. Below is practical guidance on implementation, costs and penalties.

How to effectively implement the new rules

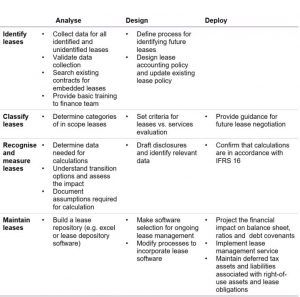

First, some good news. Up-front planning allows you to structure your IFRS 16 implementation into four smaller phases as below.

Identify – In this phase, the focus is on capturing existing lease data (including embedded leases) and reviewing existing processes and systems to help capture leases going forward.

At this stage, the new definition of a lease is used and you will need to work out what transitional reliefs are available (see end). You will also need to identify key individuals in the business (property managers, IT specialists, accountants, procurement, and liaise with the board and audit committee where relevant).

Classify – In this phase, assess your lease population to determine those that are within the scope of IFRS 16. You should be thinking about the effect that decisions could have on future lease negotiations. At this stage, consider applying practical expedients for leases of low value assets and/or short-term leases, as well as thinking of the disclosure requirements.

Measure – The measure phase breaks down the components and assumptions used in lease calculations and populating lease disclosures.

Maintain – The time spent collating and working out new lease calculations and disclosures is not something you want to repeat annually. Working through the maintain phase will help to set up your ongoing lease management to minimise the time taken to comply each year. Check that the related presentation and disclosure is compliant.

Successfully completing each step in a logical manner generally leads to a more successful implementation. Communication of the effects to stakeholders is critical throughout each phase.

Some teams find it difficult to isolate the phases. Imagine that, in starting the identify phase, you come across a filing cabinet of lease agreements. To progress through the project, the lease information needs to be available and accessible. A decision now needs to be made as to how this data will be collated and maintained in the future. Leaving this to the last phase could potentially lead to inefficiencies, with a frustrated project team having to refer back to original hardcopy documents until a decision on software is made.

To avoid this problem you should work through the four phases alongside the following three separate project stages.

Each stage helps to allocate work to maximise progression. For larger and more complex lease portfolios, the time and cost savings made can be significant.

What are the typical implementation costs?

A business might aim to achieve short-term compliance by doing just enough to report in the year of first application and have the auditors feel comfortable. Others seek a long-term approach, so that complying with IFRS 16 becomes a ‘push button’ exercise.

The more sustainable an implementation, the higher the direct costs of the project will be. The majority of the direct expense typically comprises project team time spent collating lease data, software setup, integration and ongoing maintenance.

The reduced time taken for finance teams to produce the numbers each year, a lower risk of errors and (potentially) a lower audit fee, far outweigh the additional direct costs of implementation, including external advice.

What are the penalties for not complying?

Think about those difficult conversations with the board and auditor, delayed filing penalties and (if listed) an embarrassed CFO standing up in front of analysts to explain why your numbers do not comply.

The implications are much wider. If the IFRS 16 numbers are not calculated accurately, bank covenants, employee bonuses, acquisition earn-outs and company valuations are also affected. The knock on impact of a company paying out too much money, or not enough, or finding itself in difficult negotiations with its lenders and lawyers, could be the worst-case scenario, as well as a letter of inquiry from the FRC.

The big picture and transitional reliefs

There are choices when implementing IFRS 16 for the first time. These include:

The choices regarding practical expedients and the transition reliefs available mean a careful overall implementation plan is required. Its initial implementation can directly affect the level of EBITDA, operating profit and finance costs for a number of years and your stakeholders are likely to be very interested in how you plan to implement it. Clear communication of the impact and the plan is essential throughout the whole process.

Jonathan Wallis is the Director & Financial Reporting Advisory Group Lead at Grant Thornton UK LLP, and Neil Parsons, is Senior Manager, Financial Reporting, National Assurance Services at Grant Thornton UK LLP.