How to evolve your budgeting and forecasting for today’s competitive markets

FDs can gain insights from corporate data to make informed, real-time decisions and forecast their financial standing, says data management solutions provider Altius

FDs can gain insights from corporate data to make informed, real-time decisions and forecast their financial standing, says data management solutions provider Altius

Watch the Altius webinar to discover a powerful solution that will drive efficiencies and transform your financial close process.

For enterprises in today’s fast-paced, competitive and ever-changing business environment, delivering dependable business forecasts is essential to future success. As such, CFOs are relentlessly striving to gain insight into corporate data to make informed, real-time decisions and forecast their financial standing.

Part of that process is the annual budget, which remains central to any organisation’s business planning. In our view, the major challenge with traditional budgeting is the time and resources required to run the process. For some companies it takes so long, that by the time the process is completed, the budget is already out-dated. The issue is further compounded if companies are running Excel-based budgeting systems, which are slow, restrictive and error prone.

In our experience, there is a journey involving three general steps that will enable a company to evolve their budgeting and forecasting. This is assuming that a company has decided to move away from Excel-based processes and implement an Enterprise Performance Management (EPM) tool. This is because some of the steps require the ability to leverage a system-based solution to be efficient.

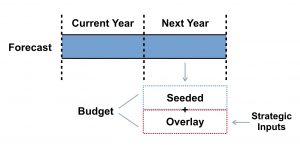

Moving to either a rolling or multi-year forecast will provide a future/forward view of at least one year ahead. A continuous forecasting process means a company can avoid creating a one-off (big bang) budget. Continuously working to refine the forecast for the future period reduces the peaks of effort loaded on finance and business resources. It also improves accuracy as the current position (in terms of numbers) is continuously reflected through incremental updates.

It is worth noting that the concept of a budget does not disappear completely, but rather a base budget is dropped out of the forecast – where overlays are applied and adjusted for strategic initiatives, growth plan and stretch targets (see below).

The second step we typically see is the shift to a driver-based planning process. This is where a business models the various factors that drive operational and financial outcomes and use these to drive the calculations that automatically produce the forecast.

For example, this approach would allow manufacturing organisations to incorporate the cost of materials and labour in the model, or allow a business to incorporate the influence of currency fluctuations based on the volume of procurement done through different channels. These different factors can be modeled and a reforecast calculated. This approach makes ‘what-if’ scenario modelling a reality as different scenarios impacting the key drivers can be considered.

This step is seen as maturing the understanding of the factors influencing business performance, and leads to a more accurate result. It also reduces the effort involved in delivering the forecast by virtue of using automated calculations.

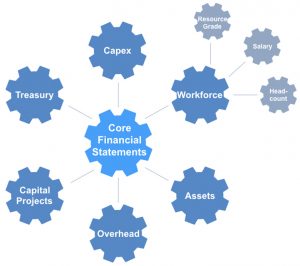

We often see that to deliver the driver-based modelling, a planning solution will break down into focused sub-models – such as a Workforce, Capex, Overhead and Treasury models. The sub-models contribute to the central master plan. Over time, a business can prioritise and expand the sub-models in order to deliver driver-based forecasting in the most relevant areas (see below).

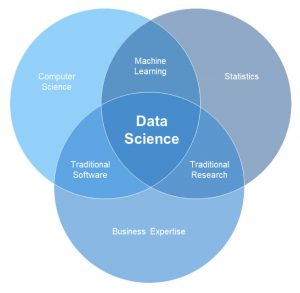

The third stage in the evolution of budgeting and forecasting is to take the driver-based models and use Machine Learning models, developed through a Data Science led approach, to predict the drivers’ inputs. In essence, have a completely machine-driven forecast output.

The field of data science is emerging at the intersection of statistics, computer science, and information technology (see below). Having evolved from data mining, it is the process of making discoveries in, and deriving knowledge from data. By applying this capability to the process of financial forecasting we are able to build machine learning models that further automate the forecasting process, and drive more accurate predictions.

It is likely that most organisations would not adopt a machine learning forecast outright in the first iteration, but rather run the machine produced forecast alongside the human generated forecast, to run comparisons and challenge the numbers being produced. Once the accuracy has been proven, the machine-based process can be adopted, and the time-savings from an automation can be re-directed into taking action off the back of the resulting forecast.

Systems support is essential to achieving the gains laid out across the three steps, and OneStream FX offers an excellent capability to support the full evolution, as it has the traditional planning capability to build the rolling and driver-based models, whilst also providing the integration to Microsoft Azure’s Machine Learning platform services. This means Machine Learning models can be easily deployed alongside the OneStream solution to feed the driver-based inputs into the sub-models, and unlock the potential for organisations having a fully automated forecast process.

Watch the Altius webinar to discover a powerful solution that will drive efficiencies and transform your financial close process.