A blueprint for financial strategy

Get strategy wrong and there’s no where else to go at the end of the day. Ben Walters believes finance can better support strategic analysis and enhance the overall value of the firm.

Get strategy wrong and there’s no where else to go at the end of the day. Ben Walters believes finance can better support strategic analysis and enhance the overall value of the firm.

It’s a given these days that the finance function is expected to contribute far outside of the traditional roles as score keeper. Gone are the days when accountants churned accounts in a seemingly never-ending cycle and go home at the end of the day knowing it was a job well done. The modern CFO is the righthand person of the CEO. They are expected to be an expert in almost every issue across their organisation and at the same time maintain and enhance their profile as a strategic leader. So often caught up in the tactical and even operational issues that all of this involves it can seem a daunting prospect to contribute and even lead on strategic direction as well. Below I discuss a simple blueprint for how this can be done.

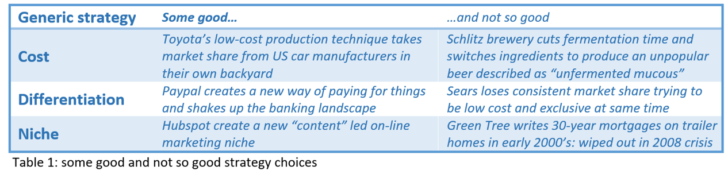

Before we get into the blueprint however, lets refresh our memories on some basic strategic principals. Table one describes some examples based on the seminal work of the grandfather of strategy, Michael Porter.

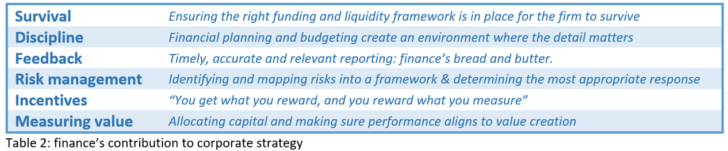

Table two takes a quick look at some of the main areas finance can contribute to overall corporate strategy.

Finance’s core contribution to general corporate strategy is to ensure it is ultimately “bankable”

It is worth making a few observations. Firstly, as a Treasurer I am duty bound to say this: survival is the absolute fundamental objective of the firm and the operational, leadership and finance functions must always be aligned behind this objective ahead of short-term profit. Next, strategic direction is the biggest risk to survival. This is easily forgotten and is not to underplay the myriad of other risks besetting a firm. But get strategy wrong and there’s no where to go at the end of the day. The last point I would like to make is that the other areas listed are all performed to a greater or lesser degree of effectiveness by the traditional finance function. But let’s face it, strategy has a tendency to be seen as a separate function, often the preserve of an elite team who distance themselves from the grinding detail the finance function lives and breathes.

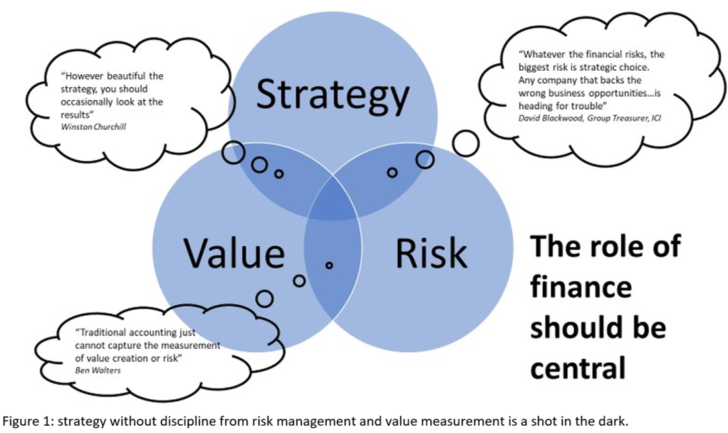

The two areas the blueprint focuses on are risk management and value measurement. There is plenty of scope for finance to break out of its traditional, and to be frank, limited, contribution to these two areas. Doing so enhances the chances of setting and executing a successful strategy. By applying the principles of risk management to the strategic planning and review process the elements of discipline and planning are enhanced. And by being able to measure value, not profit, incentives and capital allocation can be fully aligned behind value creation.

Figure one illustrates how these areas, the preserve of finance, can make corporate strategy “bankable”.

The message from figure one is that strategic direction is the biggest risk a firm faces and that strategy without measurement is a shot in the dark. Traditional accounting is limited in its ability to address both measures. But no longer. By broadening our view of what it can contribute and by embracing and championing new techniques, the finance function can move outside of its traditional role and take on the mantle of strategic leadership. Based on sound accepted corporate finance techniques this just requires the finance community, in its new role as financial strategists, to think and apply its skills a little differently.

If strategy is the biggest risk the firm faces, then logically it implies it should be assessed within a risk management framework. Why treat strategy differently to other risks? Taking the right risks is at the heart of good strategic choice. Tools such as SWOT, Porter’s Five Forces (Michael Porter, Harvard Business Review, 1979) and Value Chain analysis (Michael Porter, Competitive Advantage: Creating and Sustaining Superior Performance, Free Press, 1998) all shed light on the competencies and strengths of the firm and the risks identified in the strategy should dovetail with the these. Risks that impinge on weaknesses and non-core skills can be identified and the appropriate response can be formulated. This is not rocket science, but setting strategic decision making in a risk management framework really adds clarity to whether things stack up or not.

Setting strategy within a risk framework brings new insight and discipline to the strategic planning process.

Traditionally finance has measured profits and to a much lesser degree of analysis, cash flows. Returns on capital are often poorly understood. Add the dimension of the degree of risk undertaken to generate the reported profit, which traditional accounting completely ignores, and the limitations of a profit and loss centric view of value are obvious. Investing activities on the other hand are usually assessed on a discounted cashflow methodology which is based on cash and risk. Why is it universally accepted that we look at investing activities and financial performance from these two completely different perspectives?

Let me ask you this, do you know what parts of your firm create or destroy value? Is your strategy really working in financial terms? Are you seeing the returns on capital that you are expecting?

Traditional accounting has severe and potentially destructive limitations in the areas of allocating capital and setting targets that align to strategy and value. Yet value can be measured in a straightforward manner from the internal management information readily available within virtually every firm. The technique is simple and rests on the principal that if you are happy using discounted cash flow methodology when looking at a CAPEX investment or M&A decision, then why not apply the same approach when looking at the performance or budget of business units within the firm? You can measure value directly from your financial statements, it is easier than you think, and it is as flexible as your imagination allows. Again, not rocket science, just a willingness to look at financial data in a different way.

In subsequent articles I will describe in more detail how a risk management framework can be mapped into the strategic planning process, and how value can be measured in practical terms. Both processes are straightforward, transparent and easy to apply. In addition, I will introduce Monte Carlo simulation, the Gain-Loss spread and argue that WACC is not the correct hurdle rate when determining value in the corporate environment. An alternative hurdle rate that reflects the restraints on capital a firm faces and the growth pressures investors place on the firm through their valuation, is put forward. My website, mwacc.co.uk, is named after this new hurdle rate.

The author, Ben Walters, FCT, ACA is a practising corporate treasurer with a keen interest in the practical application of corporate finance in the real business environment. He believes finance can better support strategic analysis and enhance the overall value of the firm and has developed innovative thinking in this area. He is always keen to be contacted through [email protected]