Blueprint for financial strategy part two: a risk framework approach

The tools exist for CFO's and financial directors to better analyse a firm's strategic risk. They just need to utilise what they have in another manner.

The tools exist for CFO's and financial directors to better analyse a firm's strategic risk. They just need to utilise what they have in another manner.

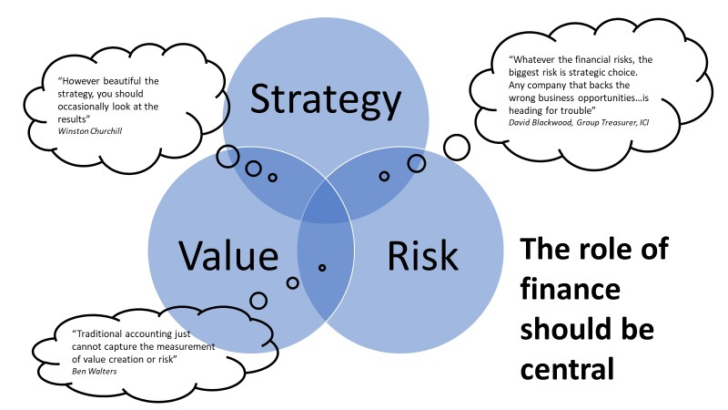

The first article in this series, “A Blueprint for Financial Strategy”, described how the finance community is being asked to become increasingly more strategic. In my experience however we often do not stop to question exactly what this means. There are two areas where I believe the finance function can add genuine value to the firm’s strategy: firstly, strategic choice, as the biggest risk firms’ face should be analysed through a risk framework. Secondly, strategy without the ability to measure the value it creates (or destroys) is a shot in the dark. Traditional accounting tools are very limited in their ability to measure value directly, but there is an easy and straightforward process that allows us to do so if we are prepared to think a little outside the box.

We have the toolbox, we just need to use it in a different manner

Probably the reason you don’t very often see strategy and risk married together in a formal manner is that the risks that flow from strategy are often hard to assess and evaluate in financial terms. Risks arising from strategic choice are often open ended and multi-faceted. At the same time our nature as financial professionals does not lend itself to dealing with the inevitable uncertainty that flows from the analysis of a corporate strategy. Finance people measure, calculate and draw conclusions from data. Even if this data is a forecast of the future, we tend to treat its truthfulness with a degree of reverence. So how can we overcome this?

It is crucial that the finance community develops the ability pull away from its traditional mindset and think a little differently. We have the toolbox, we just need to use it in a different manner. In the context of strategic risk, the challenge is to become comfortable with explaining uncertainty. Although this might seem like unfamiliar territory remember that if the firm is considering the strategy it is already considering the associated risks. The firm should be able to form a view on how these risks impact the financial results. The confidence, desire and expertise to do so should be present within the firm and if it is not then alarm bells should be ringing about the suitability of the strategic direction. For finance to truly get to grips with strategy then it must embrace uncertainty.

Even if data is a forecast of the future, we tend to treat its truthfulness with a degree of reverence.

Before we start is in important to be very clear on the generic competitive position underpinning the strategy, i.e. does the strategy compete on cost, offer a niche position in an existing market or diversification into a new market. Output from the risk framework will reveal whether the risk responses fall into pattern consistent with one of these generic competitive positions.

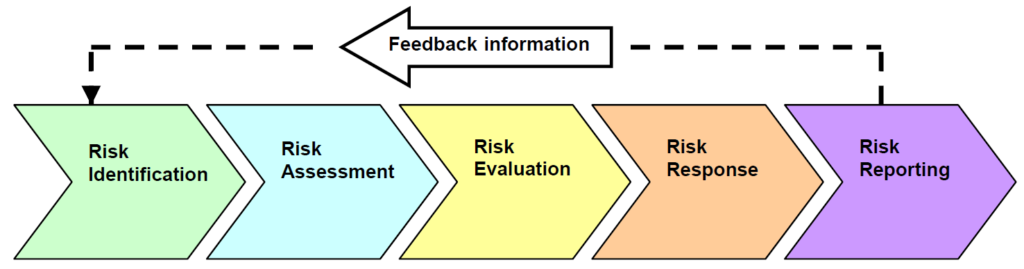

Figure two illustrates a traditional risk management framework. The starting point of which is to identify a small number of critical elements that feed into the success or failure of a proposed strategy. These are the risks that the firm is taking on when it follows this strategic direction. Figure three recaps some old favourites, SWOT, value chain and Porter’s Five forces. A fourth area to consider is the barriers to entry the strategy relies upon. These analytical techniques help identify both strategic risks and the firm’s strengths.

Figure 3: tools such as SWOT, value chain analysis and Porter’s Five forces reveal the risks inherent within a strategy

With some key risks identified the next step is to assess and evaluate these in financial terms. We need to get comfortable with looking at how these elements might change, in a good or bad way, how they interact with each other and what the financial consequences are.

In practice assessing and evaluating strategy means developing a financial base case, taking the key risks and estimating an up and downside variance over a reasonable timescale. This detailed examination starts with a question along the lines of “over a reasonable timescale, say three years, how could this risk develop and what would the financial implications of this be?” In practical terms determine some realistic up and downside scenarios and develop a feel for the sensitivity of the financial outturn to these risks. At this stage the objective is examine in detail the influence these risks have on financial performance and how these can be monitored and mitigated.

A good strategy can be defined as one whereby the firms’ strengths marry up to the associated risks allowing the opportunity to create value. Table one outlines the four generic risk responses and strategic risks should align with an accept and retain response. The responses should flow naturally from what the firm is already good at. If they do not, then the strategy is questionable.

| Response | Description |

| Accept & retain | These risks should fit seamlessly with the firm’s strengths. These are the risks the firm takes in order to create value and in which it has existing expertise to manage. |

| Accept & reduce | These are risks associated with adopted strategy but often arise simply through the act of conducting the business. The firm should reduce, control and monitor these risks. |

| Accept & transfer | These are usually risks incidental to being in business. Transfer of these risks might be through insurance, derivatives or outsourcing |

| Avoid | These are risks that the firm derives no value from accepting and at the same time an appropriate proactive response is not available. |

Table 1: generic risk responses

Regular reporting is finance’s core strength. The firm should identify some reportable metrics that indicate its core strategic risks might be deviating from expectations. This will very often involve non-financial measures. For example, customer satisfaction is pre-empted by surveys and customer behavioural analysis and not declining revenue trends. Creating a reporting process and measuring the actual direction each risk takes against the base case is a continuous process. It acts as an early warning system and allows for continuous improvement to the strategic plan.

For finance to truly get to grips with strategy it must embrace uncertainty

A risk framework creates discipline around determining where value from the strategy is coming from. Analysing a strategy through a risk framework leads to several benefits. Its forces an evaluation of the strategic risks in financial terms which in turn exposes the risk to a higher level of scrutiny. Putting numbers around the up and downsides might be uncomfortable territory in the traditional financial sense, but it is an invaluable exercise. The risks identified should align to the firm’s strengths and the natural response should be accept and retain. If this is not the case the strategy is unlikely to succeed. A formal reporting process should be developed to monitor each risk and this regular feedback not only creates an early warning system but allows for continuous improvements to made to the strategic plan.

Our discussion on the finance community’s contribution to strategy does not end here and in the next article I will move onto describe how value can be measured from traditional accounting output. This integrates value into the financial engine room and from there the value the strategy creates or destroys becomes transparent, measurable and a lever to drive success.

The author, Ben Walters, FCT, ACA is a practising corporate treasurer with a keen interest in the practical application of corporate finance in the real business environment. He believes finance can better support strategic analysis and enhance the overall value of the firm and has developed innovative thinking in this area. He is always keen to be contacted through [email protected]

Leave a Reply

You must be logged in to post a comment.